Reducing Concentrated Risk, Preserving Liquidity, and Mitigating Taxes

Executive Summary

Even the most seasoned investors need guidance in managing complexity. As a General Partner (GP) at a leading private equity firm, David* was adept at putting money to work for clients. However, the seasoned investor with a personal net worth of more than $250 million felt his own wealth management strategy was lacking. David and his wife, Helen, had a complex portfolio and estate plan but sought more structure and diversification. On top of that, they had just moved to a new state and wanted to do more to mitigate taxes.

By engaging the specialists at Caprock, a Multi-Family Office (MFO) experienced in working with sophisticated GPs, David and Helen were able to create a robust wealth management strategy tailored to their specific needs. They were also able to invest additional cash while preserving liquidity, reducing tax complexity, and optimizing their overall portfolio.

At a Glance

- General Partner (GP) at a large PE firm

- Net worth more than $250 million

- Complex portfolio with concentrated GP holdings

- DIY approach to liquidity management

- Recent change in primary state of residence

Goals and Objectives

- A wealth strategy with no liquidity issues, ever

- A method to optimize carry distribution and tax mitigation

- A sophisticated investment approach that includes maximizing risk-return, cash management yield, and liquidity

- A partner with the knowledge and experience to access and consult on new LP investments

- A sound estate strategy and beneficiary planning

- A comprehensive full balance sheet dashboard that can be accessed anytime

- A seamless transition plan for Helen should anything happen to him

Caprock’s Integrated Plan of Action

Creating a Structure and Framework to Support Both Self-Directed and Recommended Investment Strategies

Establish a Relationship and Transparent Fee Structure

Before David contacted Caprock to set up a meeting, he was already familiar with our firm. From the very first conversation, our team focused on the couple’s unique circumstances and goals for their wealth, most of which revolved around tax efficiency and liquidity. We explored what strategies they already had in place, as well as what services and investment support they desired.

Together, we established a dedicated team based on their requirements. This included working with a CPA and national tax experts to defer taxes on capital gains and take advantage of tax-loss harvesting strategies. The couple was comforted by the fact that Caprock would not push financial products or charge additional fees or commissions based on the investments they chose. These steps ensured the family that they would receive objective-based, holistic financial management with a transparent, aligned advisory fee structure.

Creating a Structure for All Assets

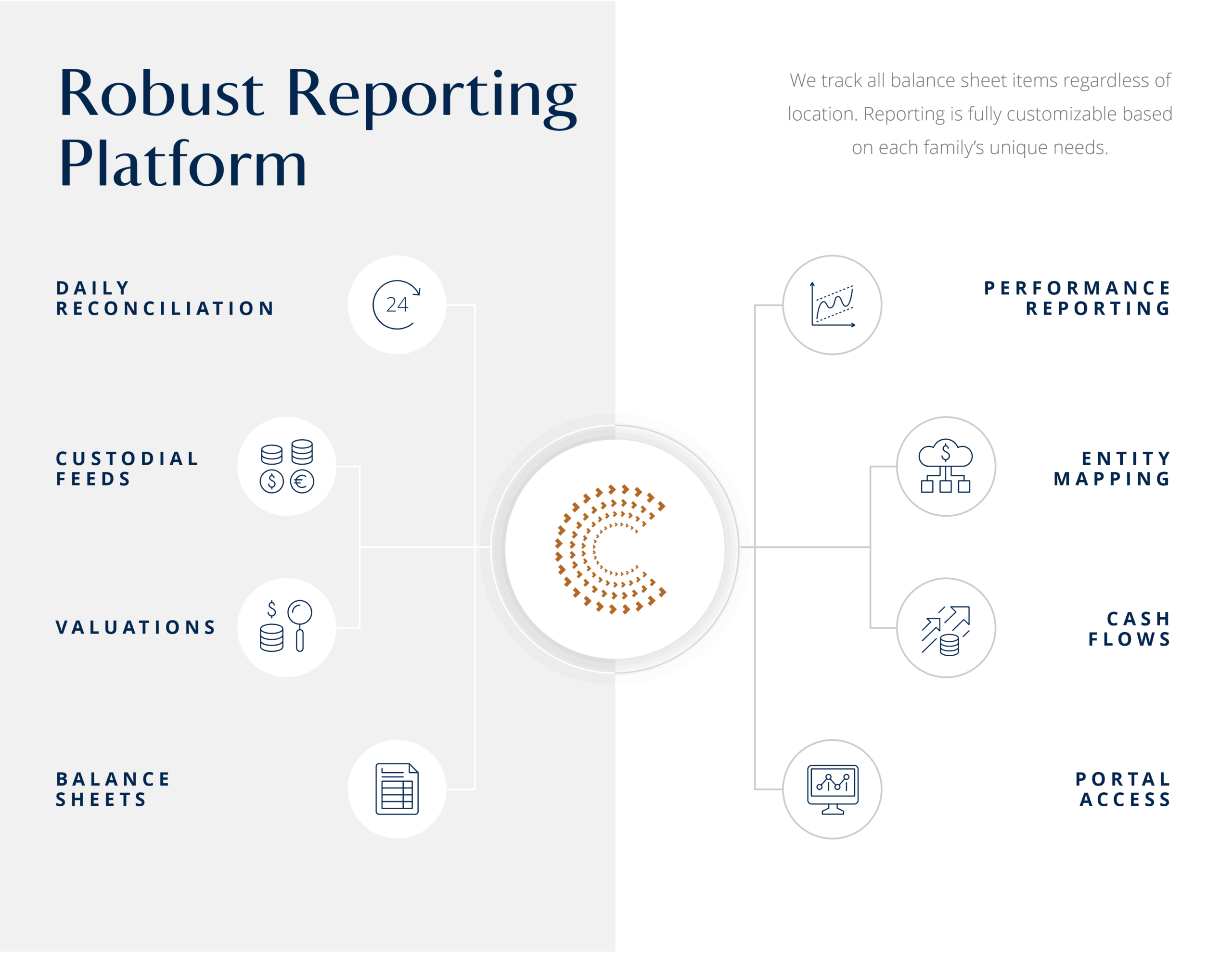

Our approach to developing a personalized plan started with a comprehensive onboarding process. We were able to collect fragmented financial reporting from multiple sources – including 25 brokerage accounts across 20 distinct family entities – and integrate it into our open architecture reporting platform, giving us a thorough understanding of the vision David and Helen had for their complex financial situation.

Once on a single platform, they had access to a comprehensive, full balance sheet structure that included all their assets, investments, and obligations. The disparate aspects of their accounts indicated extra liquidity that could be working better for them.

Self-Directed and Recommended Investment Strategies

We built upon the foundation they created through their own estate planning and crafted a bespoke, yet simplified, strategy that delivered what they wanted most – liquidity, diversification, tax mitigation, and a framework to support both self-directed and recommended investment strategies.

Our flexibility and platform access allowed David and Helen to be hands-on with their investments while leveraging our team’s decades of experience for guidance. We became a valued sounding board for investment opportunities. Our tailored approach to simplifying their wealth gave David and Helen a foundation for evaluating multiple scenarios and a greater understanding of their overall financial picture, thanks to a robust system that linked together their varied financial resources.

Strategic Portfolio Diversification

Given the extensive number of concentrated investments, our team ran an in-depth liquidity analysis to identify the options and benefits of putting more cash to work. The results provided the couple with a clear picture of their outstanding commitments and what could be utilized for increased yield and reduced financial risk.

Since their wealth was concentrated in public and private equity, we diversified into other asset classes like real estate, fixed income, private credit, and venture investments to broaden their exposure. We now manage and track more than 80 custom assets for David and Helen, including nearly 20 with GP carried interest, more than 25 PE co-investment vehicles, and five separate credit lines. The remainder is comprised of personal assets and a mix of private investments identified by David and Caprock.

Placing Tax Mitigation at the Forefront

Our team structured David and Helen’s investments to minimize tax implications and maximize liquidity. By optimizing their investments in trusts and co-investments in qualified opportunity zones (QOZ), which provided real estate exposure and tax mitigation, we were able to significantly reduce the complexity of David and Helen’s tax burden.

We worked closely with their estate planning attorney to utilize carry distributions for incremental gifting to trusts. This strategy has helped David and Helen time the movement of additional wealth, with significant upside potential, out of their estate.

We provided their estate attorney and tax professionals with access to our platform. Here we could easily share information and collaborate to address ongoing changes as they came up, including the complications of multiple state residences and ever-changing tax laws. David also had several LLCs requiring assistance with adhering to disclosure requirements.

The transparency and collaboration among David and Helen’s team of professionals created efficiencies and reduced the risk of changes in one area negatively impacting another.

Fast Forward

Today, David and Helen have maintained control of their investments and are benefiting from a team dedicated to streamlining their finances, mitigating taxes, and diversifying their portfolio.

They have access to more diversified investment and co-investment opportunities in private markets and are benefiting from a simple, transparent fee. They have the resources and support they need to maintain their desired cash on hand and liquidity, keep more of their money, and navigate evolving market conditions.

With Caprock in their corner, they now have a comprehensive structure for their entire balance sheet, all viewable on a single dashboard, and their cash is working more efficiently than ever before. They have confidence and peace of mind for the future of their wealth.

Our Advice

- Work with advisors who place you in the driver’s seat and are familiar with a variety of private investment opportunities.

- Maintain a diversified portfolio to minimize concentrated risk and ensure all assets work together efficiently.

- Ensure liquidity planning and tax management strategies are aligned with your goals and handled by professionals with deep experience in concentrated GP positions.

Contact a Caprock advisor to take the first step toward financial clarity, control, and confidence for the future.

Download a PDF of this Case Study

*This case study is based on a current Caprock client, but the names have been changed to protect their identity and maintain confidentiality. The client was not compensated in any form. While every effort has been made to accurately portray the details of the case, certain elements may have been modified or excluded to further safeguard the privacy of the individual. This case study is intended for informational purposes only and should not be seen as a substitute for professional financial advice. The results and outcomes described in this document are specific to the individual client and may not be applicable to all situations. This case study is intended to provide general information about Caprock and is not a solicitation or offer to sell investment advisory services except in states where we are registered or where an exemption or exclusion from such registration exists.

©Caprock. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or training.