We go beyond fiduciary.

Caprock provides sophisticated financial solutions and investment options that meet our clients’ goals.

Caprock’s multi-family office approach is to assign a team of professionals to each client family based on their specific needs. We start with a conversation about you and your family’s needs, as well as the legacy you want to leave behind. The only way to build a customized strategy is to cultivate a relationship based on persistent attentiveness and pointed expertise.

Since your needs can’t be confined to a category, a risk profile, or a time horizon, we help you ascertain what you want to accomplish with your wealth. Equipped with that clarity, we begin to construct a portfolio that is customized to your family’s needs.

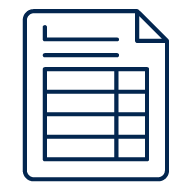

Multi-Family Office Services

Wealth Management

- Consolidated Reporting

- Comprehensive Financial Planning

- Cash Flow Forecasting & Budgeting

- Cash Management

- Pre-Transaction / Liquidity Event Planning

- Private Business Transaction Support

Estate Planning

- Wealth Protection Strategies

- Wealth Transfer (Succession Planning)

- Next Gen Engagement / Education

- Estate Attorney Collaboration

- Comprehensive Insurance Review

Tax

- Tax Document Consolidation & Organization

- K-1 Tracking

- Accountant Coordination

- Tax Optimized Portfolio Construction

Lifestyle Services*

- Bill Pay / Bookkeeping

- Concierge & Travel Services

- Private Aviation Services

- Security – Cyber & Physical

* For certain services we utilize trusted partners

Philanthropy

- Foundation Creation and Management

- Charitable Giving Facilitation

- Gifting Recordkeeping

- Donor Advised Fund (DAF) Oversight

Personal Estate

- Contract / Deal Structure Review

- Customized Borrowing Options

- Document & Due Diligence Management

- Property Manager Sourcing

Fully Customized For You

We not only source investments to create tailored solutions, but we also partner with you to evaluate opportunities that arise directly from your network. Caprock’s depth of experience, diversity of backgrounds, and unmatched in-house expertise make it well-suited to manage the complex needs of ultra-high-net-worth clients across all asset classes.

Broad Investment Platform

Cash

- Money Market Accounts

- Certificates of Deposit

Fixed Income

- Governments

- Corporates

- Municipals

- Green Bonds

- Affordable Housing Bonds

Public Equities

- Exchange Traded Funds

- Separately Managed Accounts

- Options Strategies

- Tax Loss Harvesting

Alternative Investments

- Alternative Credit

- Long/Short Equity

Real Assets

- Real Estate

- Operating Assets

- Infrastructure Assets

- Commodities

- Project Finance

Private Investments

- Private Equity

- Private Debt

- Venture Capital

- Co-Investments

- Direct Investments

Our Investment Philosophy

We believe the key to long-term wealth creation is consistent compounding of after-tax returns.

Avoiding significant portfolio drawdowns, which can take years to recover from, is the main principle of this concept.

Caprock’s clients are in a unique position as they are already successful in their financial endeavors. It is our responsibility to maintain this situation by consistently safeguarding and growing their wealth, regardless of the state of the market. We accomplish this by employing an endowment-like strategy to deliver consistent returns to our clients.

“Caprock is no drama, a place where they know the clients and bring forward opportunities that match them. A place where your primary goal is to sleep well at night.”

Bill C., High Profile Business Leader

Caprock Client