Global capital markets started 2025 on a strong note, with equities rallying and bond yields stabilizing. The MSCI All Country World Index rose +3.4% in January, driven by broad-based sector participation. The S&P 500 gained +2.8%, with cyclicals such as Financials (+6.5%), Industrials (+5.0%), and Health Care (+6.8%) leading the market, while Big Tech contributed little. Europe outperformed (+6.4%) after lagging in 2024, benefiting from strong financial sector performance. Meanwhile, Emerging Markets and Japan both posted a solid +1.8% return. Gold (+7.2%) and Silver (+10.2%) outperformed equities, reflecting ongoing demand for hedges against macro uncertainty.

Treasury yields played a key role in investor sentiment, with the 10-year yield peaking at 4.80% mid-month before easing to 4.54% after a market-friendly inflation report. Stability in fixed income markets, coupled with a widening equity rally, suggests continued economic strength and confidence in 2025 growth prospects. With cyclicals and small caps gaining traction, the equity market remains in a mid-cycle expansion, favoring continued participation in Financials, Industrials, and Health Care.

Threatened U.S. tariffs on Canada, Mexico, and China have sparked concerns about trade frictions, but markets have largely absorbed the news. While tariffs may create short-term disruptions, companies had time to prepare, and the U.S. economy appears strong enough to weather these challenges without derailing growth. Investors remain focused on the broader economic picture, and as long as recession risks remain low, equity markets should continue to find support.

The following table contains a summary of January and year-to-date market performance:

| Index | January | YTD | Index | January | YTD |

| S&P 500 (Total Return) | +2.78% | +2.78% | MSCI All Country World (Net) | +3.36% | +3.36% |

| MSCI EAFE (Net) | +5.26% | +5.26% | Bloomberg Barclays US Agg | +0.53% | +0.53% |

| MSCI Emerging Markets (Net) | +1.79% | +1.79% | 60/40 Blend* | +2.23% | +2.23% |

* 60% All Country World Index / 40% Bloomberg Barclays US Aggregate Bond Index

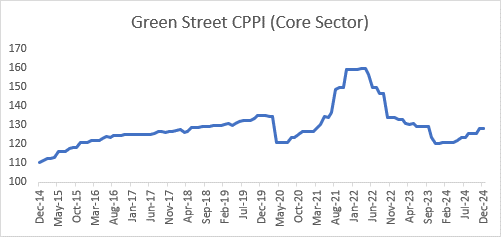

The past two years have been challenging for real estate investors with higher interest rates depressing property values, reducing yields, and extending holding periods. According to the Green Street Core Sector Commercial Property Price Index, real estate values declined 24.6% from their peak in April 2022 to their trough in December 2023 and recovered 6.5% in 2024.

As the Fed began to telegraph rate cuts in mid-2024, expectations were high that mortgage rates would quickly decline and usher in a real estate recovery. Stressed real estate investors adopted the hopeful mantra “survive until ‘25”. Lenders too, sitting on loan portfolios with impaired assets as collateral, remained patient and in some cases adopted an unofficial policy of “extend and pretend”, as they waited for markets to turn around.

While the Fed did begin cutting rates in September of last year, the resilient economy and stubborn inflation have caused the Fed to pause after just 100 basis points of cuts. This leaves the Fed Funds rate at 4.5% – an improvement to be sure, but well above where most observers expected rates to go. The outlook for additional rate cuts in 2025 remains uncertain. This has extended the illiquidity in commercial real estate beyond initial projections, leaving many investors wondering, “We made it to 2025, now what?”

The answer for many will be extended hold periods. A property acquired near peak valuations in 2021 with an underwritten five-year hold will likely require an additional two to three years to ride out the market volatility and recover value. Debt modifications may also be necessary to extend mortgage terms, which could negatively impact yield as the cash that is generated by the property is required to service debt rather than being distributed to investors. Real estate investors who used modest leverage in the 2019 to 2021 period may still be able to post modest returns, but it will take longer and likely fall well short of initial return expectations.

Conversely, the current market dislocation presents compelling opportunities for new real estate investments with the potential for outsized returns. As distressed sellers are forced to find solutions to their liquidity issues, investors can acquire properties at meaningful discounts from recent valuations despite stable average occupancy and rent growth for property types such as multifamily housing and industrial.

In addition, the lack of distributions from portfolios that should be winding down has hindered investment managers as they seek to raise new capital. As a result, investors who are willing and able to make commitments to new funds have considerable leverage when negotiating management fees and carried interest, which can narrow the spread between gross and net returns. Caprock has capitalized on this dynamic and secured meaningful fee discounts for our clients on several real estate investments made in 2024. Real estate is an important component of a well-diversified portfolio. Following multiple years of below-average returns for the asset class, it is a prudent time to rebalance exposures, take advantage of the decline in values, and be positioned for a market recovery. Historically, investments made during market corrections have generated the strongest returns, and we believe this current cycle in commercial real estate will be no exception.

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training.