Overnight Wealth: The American Dream

With waves of acquisitions and initial public offerings (IPOs) emerging in the U.S. each year, equity stakeholders of fast-growing companies are becoming wealthy overnight. Examples like design software provider Figma, whose market value quickly rocketed to nearly $60 billion following an IPO earlier this year, are becoming more common. As innovators in technology, healthcare, cybersecurity, and other sectors produce more unicorns (startups valued at $1 billion or more), they also produce more ultra-high-net-worth individuals and families.

Whether through an IPO, a merger, or an acquisition, if you are the beneficiary of such a major liquidity event, you may find yourself navigating the excitement of a life-changing windfall and the complexities of tax mitigation and estate planning. To fully capitalize on the success of such a transformative event, it’s crucial to have a strategic plan in place.

Caprock was created by entrepreneurs who understand the unique needs of founders and early employees coming into significant wealth through a business liquidity event. Our advisory team is well-equipped to provide you with a personalized plan wherever you are in the process.

Here are several tips that will help guide you through the journey.

Before a Company Transaction

Strong planning before the transaction will lead to stronger outcomes. The sooner you begin the process, the better you can mitigate taxes and lay the foundation for growing your wealth so that it lasts for generations. More time spent planning means more time spent gathering the tools for success.

Determine your objectives. While everyone has an idea of what they would do with a lot of money, if yours is not intentional, plan on paying a lot of taxes. To avoid this, set clear financial and personal goals you would like to reach following a major liquidity event. A few thought starters:

- Establish short-term goals for your immediate family. This could include real estate purchases, relocations, travel, retirement, etc.

- Incorporate plans for helping others. Perhaps you want to help care for other family members, pay for your child or grandchild’s college expenses, or establish a trust.

- Explore your philanthropic aspirations and interests.

- Create a long-term vision. Looking ahead 10 years or more, what is most important for your financial picture?

Define your timeline. Doing so will help maximize the benefits of the transaction, including tax implications and investment opportunities. In many cases, timing is everything. For example, estate planning structures should be created long before a sale, Donor Advised Fund (DAF) contributions should be made just before a sale, and Qualified Opportunity Zone (QOZ) investments should be made within 180 days after the sale.

Get organized. For a smooth transaction and solid foundation, you must be organized. Gather key documents like existing investment statements, loans, assets, tax documents, and any other financial records that help create a complete balance sheet of your current financial situation.

Build your team. Start by securing a wealth advisor who has extensive experience in supporting the complexities associated with personal wealth attained through a business transaction. If you anticipate receiving $10 million or more as part of a liquidity event, you should consult with an advisor at a Multi-Family Office (MFO) that specializes in serving affluent families and has deep knowledge and access to private market investments.

A multi-family office can provide highly personalized services and bring together a core team of professionals. Your team should include an estate attorney who can set up trusts and estate plans to protect and shield assets. They can also help avoid legal complications and advise you on taxes and estate laws that change regularly.

Additionally, and equally as important, your advisor can connect you with a Certified Public Accountant (CPA) who specializes in complex tax planning and regularly works with high-net-worth clients. They should be collaborative in working with your wealth advisor to minimize income, estate, and capital gains taxes. They should also be well-versed in state tax considerations for each state where you have properties, businesses, or trusts.

Assembling a sophisticated team will help you navigate the complexities of the transaction and can provide guidance and support in establishing a personalized wealth management strategy to meet your long-term goals.

Contact Caprock today to start assembling your personalized advisory team

After a Company Liquidity Event

Take a breath. Don’t be in a hurry. You’ve reached a life-altering milestone, which can be exhilarating, but making hasty financial decisions post-transaction can lead to significant and long-lasting consequences. For example, rushing into high-risk investments without proper due diligence can result in major losses that could have been avoided with the help of professional guidance. Overspending on luxury items, real estate, or other lifestyle upgrades can quickly deplete wealth if a solid financial plan is not in place. And failing to establish proper legal and estate structures can bring confusion, family conflict, or even legal battles.

Engage your financial team to build a personalized plan. If you haven’t already, focus first on building your team. They will need to create a holistic financial plan that addresses both short-term considerations, such as taxes and cash needs, and long-term vision, like retirement, philanthropy, and legacy.

Solve for liquidity. Make this a priority. Work with your advisor to assess how much cash you need for your lifestyle, major life events, and unexpected emergencies. Consider things like retirement, college tuition, buying a new home, healthcare expenses, or starting or investing in a new business venture.

Be intentional with asset allocation. Create a diversified investment strategy to manage risk and optimize returns. Diversification helps you weather volatile market cycles and protect your wealth long-term.

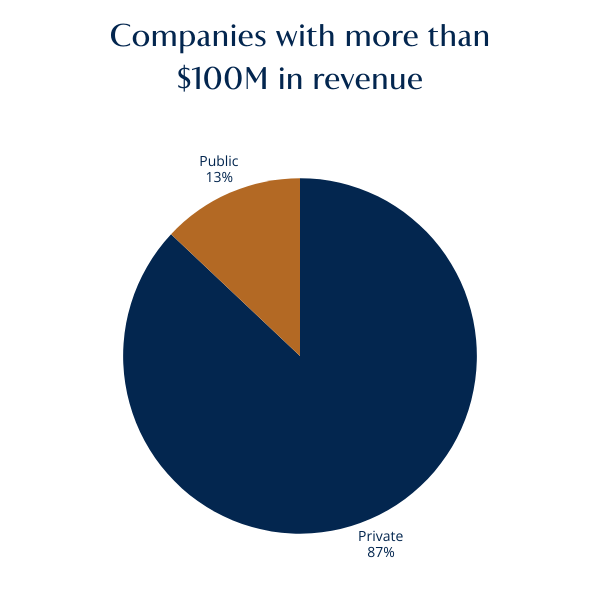

Consider private markets. There are a lot of opportunities here, as 87% of all companies with more than $100 million in revenue are private.

When done well, excess liquidity can be leveraged in private markets to reduce portfolio volatility and improve returns. That said, it’s important to understand the landmines that exist in private markets. Work with a firm that has deep access to private markets and a successful track record in private investing. A commitment to extensive diligence, which led Caprock to be an early investor in five of the top 10 CNBC Disruptors, is a must.

Enjoy life. You earned it. Or perhaps you are interested in pursuing your next career opportunity. Either way, you deserve a tailored strategy and team that can support, protect, and grow the wealth you have worked so hard to attain.

Explore opportunities tailored to your unique situation

Transaction Planning FAQ

What should I do first after receiving a major windfall from my startup’s IPO?

Take a breath and avoid making hasty financial decisions. Engage your financial team to build a personalized plan that addresses both short-term and long-term considerations.

How can employees minimize taxes when selling stock options after an acquisition or IPO?

Strong planning before the transaction will lead to stronger outcomes. Set clear financial and personal goals, define your timeline, and use tools like Qualified Small Business Stock (QSBS), estate planning structures, and Donor Advised Fund (DAF) contributions.

Who should I hire to manage my money after sudden wealth from company equity?

Start by securing a wealth advisor with extensive experience in supporting personal wealth attained through a business transaction. Your team should also include an estate attorney and a Certified Public Accountant (CPA) who specializes in complex tax planning.

How do early employees at unicorn companies typically manage wealth after a liquidity event?

They engage their financial team to build a personalized plan, solve for liquidity, create a diversified investment strategy, and consider private markets for investment opportunities.

What are the most common mistakes to avoid after an IPO or acquisition windfall?

Avoid making hasty financial decisions, rushing into high-risk investments without proper due diligence, overspending on luxury items, and failing to establish proper legal and estate structures.

What happens to stock options in an IPO?

Stock options can be exercised and sold, but it’s important to understand the tax implications and have a strategic plan in place to manage the resulting wealth.

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training. Caprock, its Employees, Affiliates and Advisers are not tax or legal professionals and do not provide such advice. Therefore, the discussions contained herein are for informational purposes only and should not be construed as a recommendation or endorsement of a strategy. Please consult with your tax or legal professional for further guidance and information. Caprock invests client capital through a variety of structures, including blended vehicles and direct investments.