It’s no secret that investing in private markets can generate substantial returns, but sophisticated investors know that the illiquidity and disparity of returns inherent in this market can increase risk substantially.

Unlike public markets, which offer next-day liquidity, private market investments can lock up capital for a decade or more. Taking a steep discount in a secondary market transaction is often the only way to return capital from an investment that is underperforming expectations.

In addition, the spread between the top decile returns and bottom decile returns in a category such as venture capital can mean the difference between a strong return on capital versus simply a return of your capital.

The key to unlocking the full potential of private market investments lies in partnering with a trusted advisory firm. One that has a robust due diligence process to help identify top decile managers and comes with a long track record of providing access.

A Sound Process for Evaluating Fund Managers

Caprock has been investing in private markets for over two decades on behalf of our clients. Over that timeframe, we have refined our sourcing and due diligence framework into what we call our Six P’s of Manager Due Diligence. This approach encompasses price, performance, portfolios, processes, philosophy, and people.

People—We assess whether the general partners’ incentives are aligned, whether the team composition has remained stable, and whether they have the experience and capacity to deliver the desired results. This evaluation focuses on decision-making, organizational stability, and the team’s ability to execute the strategy effectively.

Philosophy—We ask what the manager is trying to achieve and why their approach should succeed. Managers must have a clearly articulated, tested philosophy that explains their sources of return and can withstand varying market conditions.

Process—Is the investment process repeatable and disciplined? We look at sourcing, portfolio construction, and risk mitigation, as well as the manager’s ability to evolve thoughtfully when needed.

Portfolio—Does the portfolio reflect the investment philosophy and process? We assess holdings, concentration, and exposure to ensure the portfolio is designed to perform across market cycles.

Performance—Does the manager deliver consistent and repeatable returns? Plain and simple.

Price—How will fees impact client returns? We examine fund manager economics and determine whether clients are charged market-competitive rates.

Harnessing Diversified Access to Private Investment Opportunities

In our experience the long-term compounding of after-tax returns is what truly protects and grows wealth. This approach drives how Caprock builds portfolios and harnesses private investment opportunities. We craft diversified portfolios that take advantage of public equity, public debt, private equity, and private debt. This investable universe allows us to balance liquidity, combine low-cost market exposure with differentiated opportunities for alpha, and craft portfolios that reflect your unique goals, tax profile, and risk tolerance. We design portfolios by deliberately integrating both public and private markets, with the purpose of increasing resilience throughout market cycles.

The Value of Fund Manager Selection

The degree of success among fund managers may vary quite a bit. Managers in the top quartile can significantly outperform those in the quartiles below. This reality makes fund manager selection more critical to private market outcomes than market timing itself. Our fund manager selection is focused on their outcomes, prioritizing managers with repeatable skill sets and strong economics while avoiding managers with inconsistent processes, lackluster performance, and overpriced fees. Accessing top-tier managers often depends on early and deep relationships that are built on trust, experience, and past collaboration. Being a part of an established network can provide access to opportunities that are otherwise unavailable. Our longstanding relationships and institutional experience help investors gain early access to promising funds.

Handling Opportunity Overload with Precision

Caprock’s process for selecting private market opportunities is highly selective. Each year, Caprock reviews up to 1,000 private market opportunities, selecting only the top 2.5% for rigorous due diligence—demonstrating our commitment to quality over quantity.

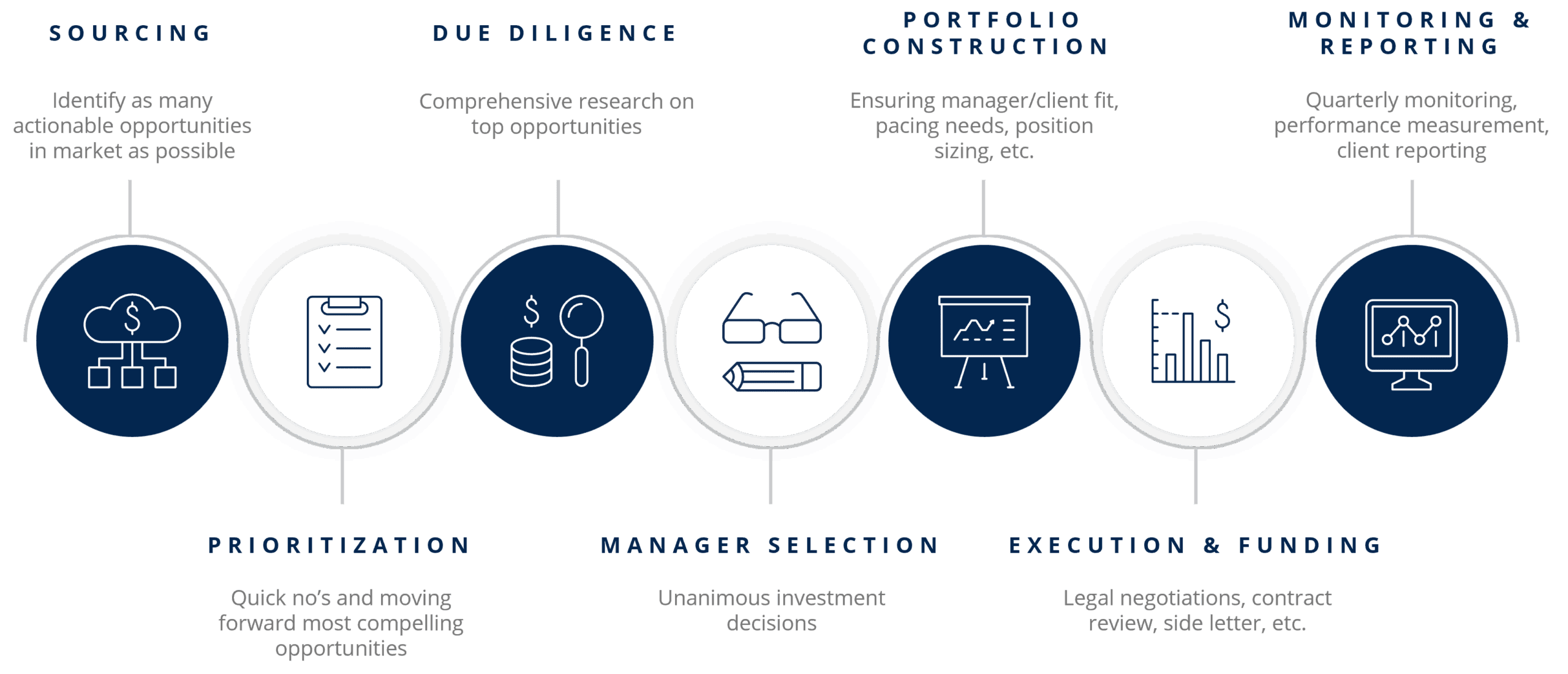

Caprock’s dedicated investment team adheres to our thorough investment process that ensures discipline, rigor, and alignment at every stage. From sourcing to extensive due diligence to manager selection, monitoring and reporting, we ensure continued oversight by keeping investors informed and aligned with their long-term objectives.

Only when handled with rigor and thoughtful evaluation can private markets serve as a powerful tool for wealth preservation and growth. With our Six Ps of Fund Manager Due Diligence, clear investment tenets, and committee-based governance, we seek to maximize risk-adjusted returns.

With billions of dollars invested in private markets since 2005, Caprock is well-versed in taking full advantage of the exclusive and highly sought-after opportunities that lie within.

Explore Caprock’s private investment opportunities.

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training. Caprock, its Employees, Affiliates and Advisers are not tax or legal professionals and do not provide such advice. Therefore, the discussions contained herein are for informational purposes only and should not be construed as a recommendation or endorsement of a strategy. Please consult with your tax or legal professional for further guidance and information. Caprock invests client capital through a variety of structures, including blended vehicles and direct investments.