Ultra-high-net-worth individuals and families face a common predicament throughout market cycles: hold fast to traditional stocks and bonds and hope to ride out the storm, or diversify into alternative investment opportunities to protect and potentially grow wealth? The most sophisticated investors are increasingly opting for the latter, looking beyond public markets to the vast world of private market investing as an anchor in uncertain times.

Private market investing has swelled exponentially over the last 20 years, becoming a $17 trillion industry. Still, they remain underutilized and challenging to access for most investors, with many financial institutions charging excessive product fees. Meanwhile, private companies shaping tomorrow’s economy, from groundbreaking tech firms to innovative healthcare providers, are growing significantly, mostly outside of public view.

Once considered niche, private markets have become a foundational element of well-crafted portfolios. Investors on the sidelines of these opportunities can miss out on considerable wealth creation.

Caprock has helped clients navigate private markets since 2005, delivering access to some of the most in-demand opportunities. We’ve seen firsthand how private markets can create significant long-term value for ultra-high-net-worth investors. Notably, Caprock’s clients were early investors in five of the top 10 companies on CNBC’s 2025 Disruptor 50 list of businesses reshaping their industries.

Benefits of Investing in Private Markets

Part of what makes private market investments such as private equity, venture capital, private credit, and real assets so attractive is the potential to generate excess returns in exchange for accepting illiquidity risk. Private investments reward long-term commitment, while success and failure in public markets can reflect short-term fluctuations in asset value. With access to private markets, investors can also benefit from exposure to companies at earlier stages of growth, where much of their value creation is formed.

Building on this foundation, it’s worth exploring some of the specific elements that can drive private market returns. In our experience, private equity and private credit are among the most impactful options for ultra-high-net-worth investors.

Ownership in companies not listed on public stock exchanges is known as private equity. Investors commit capital to private equity funds, which then buy businesses to improve and sell them at a multiple of the original investment.

Private credit is lending that happens outside traditional banks and bond markets. Instead of borrowing from a bank, a company borrows from a private credit fund that is backed by investors, who can then earn returns through interest payments.

Source: Burgiss, CDLI, S&P, HFRI, Bloomberg.

The Long-Term Strategy of Private Market Investments

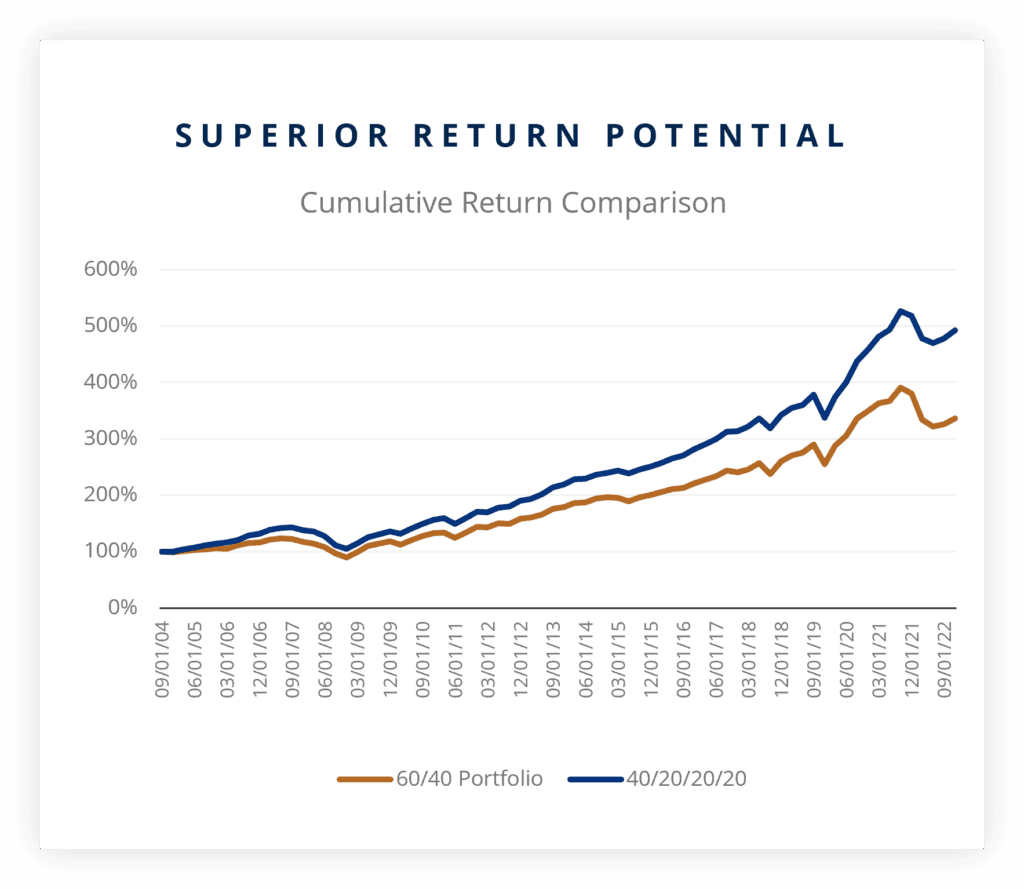

The benefits of private market investments often lie in their compounding growth over time. In our experience, leveraging private equity and private credit in a traditional 60/40 portfolio can boost returns and reduce portfolio volatility. Through exposure to innovative companies before they hit public exchanges, investors are positioned to capture more value.

Private equity, venture capital, real estate, and more all help diversify portfolios and strengthen resilience. Investing in funds available through private markets allows investors to avoid the chaos of short-term movements in public markets and concentrate on long-term growth. That said, the rest of the portfolio must provide liquidity, distributions, and cash flow along the way, so an investor is not just holding on to illiquid, compounding, private market assets.

Where Investors Put Their Money

Asset allocation trends highlight the growing shift toward private markets. Institutional investors, family offices, and the ultra-high-net-worth are steadily increasing their exposure as access grows and their understanding deepens. Additionally, multi-family offices like Caprock are establishing co-mingled opportunities for investors to provide an additional layer of diversity and exposure. Sometimes referred to as or “alternative investment products,” the products allow a single line item of allocation to have exposure across a diverse set of managers and investments. We advise investors to make sure they understand the fees that many firms and banks will charge for these. Caprock has established a structure for its clients that doesn’t include any extra layer of fees.

Investments in private equity, private credit, and venture capital have evolved from being outliers to becoming primary components of a diversified portfolio. This shift reflects a growing recognition that private markets offer unique opportunities for wealth creation that are not available via public markets.

But, of course, exposure to private markets is not without risk.

Balancing Risks and Considerations

Illiquidity, longer investment horizons, and concentrated exposures can create challenges for unprepared investors. However, the right expertise coupled with disciplined risk management can mitigate the risks in private markets. Caprock’s history of tapping into private markets positions us to thoughtfully evaluate opportunities, balance risks, and construct portfolios that align with each client’s goals.

As Vivek Jindal, Caprock Chief Investment Officer, shared in Allocate’s Alternatives Unfiltered: Venture, Private Equity, and the Future of Investing podcast when thinking about alternatives and investments in general, start with risk, then build toward returns. This mindset drives how Caprock designs private-market portfolios. For example, middle-market private equity can provide ballast, private credit can generate early distributions, and those flows help fund venture capital and growth equity commitments that take a decade or more to pay off. The result is what we call an “ecosystem” approach to sourcing private investments. Our client-tailored approach strikes a balance among liquidity, stability, and innovation.

That said, sourcing is only half the equation. Constructing portfolios to avoid over-concentration is also critical. For example, you don’t want to wake up years from now and realize all your private funds are exposed to just one sector like consumer, healthcare or AI. Caprock ensures clients get the right balance: early access, diversified exposure, hard to source managers and the opportunity to lean into areas they care about most. We evaluate not just the fund opportunity but also how it fits within each client’s broader portfolio.

Private markets have evolved over the last two decades from a niche corner of finance into a multi-trillion-dollar industry. They offer diversification, enhanced returns, and access to innovation before it reaches public markets. Ultra-high-net-worth investors increasingly recognize the benefits of private markets as essential in uncertain times. These opportunities are no longer just alternatives – they have become necessities.

At Caprock, we have a diverse team with deep experience in private markets. We have more than $4 billion invested in private markets on behalf of our clients across 220 private fund investments. With more than 20 years of experience in investing in private markets, Caprock’s dedicated private market investment professionals are ready to answer any questions you may have.

Preserve and grow your wealth with Caprock.

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training. Caprock, its Employees, Affiliates and Advisers are not tax or legal professionals and do not provide such advice. Therefore, the discussions contained herein are for informational purposes only and should not be construed as a recommendation or endorsement of a strategy. Please consult with your tax or legal professional for further guidance and information. Caprock invests client capital through a variety of structures, including blended vehicles and direct investments.