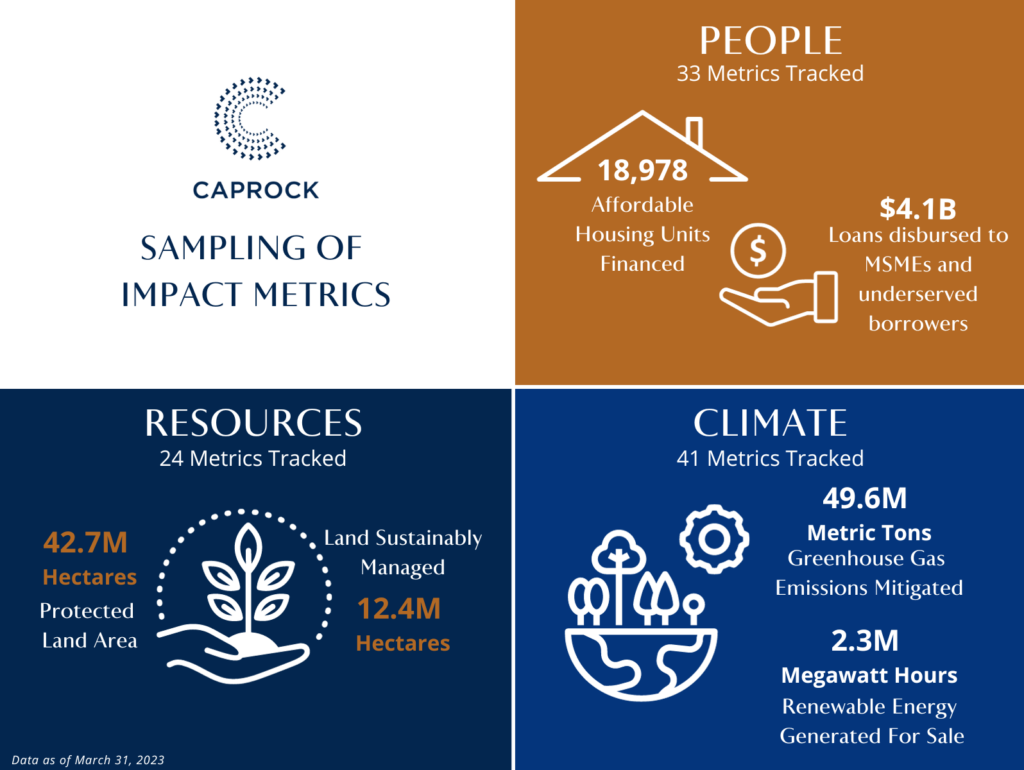

A sampling of metrics highlights positive impacts in affordable housing, resource sustainability, and renewable energy.

BOISE, ID, September 20, 2023 – Caprock, a leading multi-family office Registered Investment Advisory (RIA) firm, is publishing a sampling of the impact generated by its clients’ investments. The firm advises more than 200 families and foundations, many of whom seek to generate competitive financial returns alongside quantifiable social and environmental benefits.

Caprock created its impact performance assessment and reporting tool in 2014. The proprietary system aggregates impact metrics within each client’s portfolio, as well as across the entire firm. Today, the firm’s impact reporting platform tracks over 100 active metrics from various private market investments. The below chart includes six representative metrics across three core themes.

While Caprock’s platform has evolved over the years, their impact reporting efforts have always had two distinct aims.

First, to support clients—specifically, their engagement with, understanding of, and appreciation for the impact they catalyze through their investments. Caprock has always believed the private markets offer the best avenue through which impact can be pursued. Environmental, social, and governance (ESG) considerations are important. However, the firm has found that the private markets offer impact that is more direct and discernible. The numbers below reflect this approach and purposefully exclude the ESG data that could be tabulated across clients’ countless stock and bond holdings.

The second purpose of Caprock’s impact reporting efforts has been to bolster their internal assessments of impact investments. The firm considers financial performance reporting an essential risk management tool. Since the initial development of the impact reporting platform, it has been imperative that the framework provide actionable insights throughout Caprock’s due diligence process. The firm requires every impact asset manager with whom it invests to provide related metrics on at least an annual basis.

Against that backdrop, here are six representative metrics that reflect the aggregate impact performance of asset managers to whom the firm has allocated capital:

The Caprock Group, LLC (“Caprock”) is an SEC registered investment adviser. Registration with the SEC does not imply a certain level of skill or training. The information and opinions contained in this document are for informational purposes only and is not intended to serve as specific financial, accounting or tax advice. While reasonable care has been taken to ensure that the information herein is factually correct, Caprock makes no representation or guarantee as to its accuracy or completeness. Certain information has been provided by third-party sources and it has not been independently verified and its accuracy/completeness cannot be guaranteed. This document is for private circulation only. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any investment.