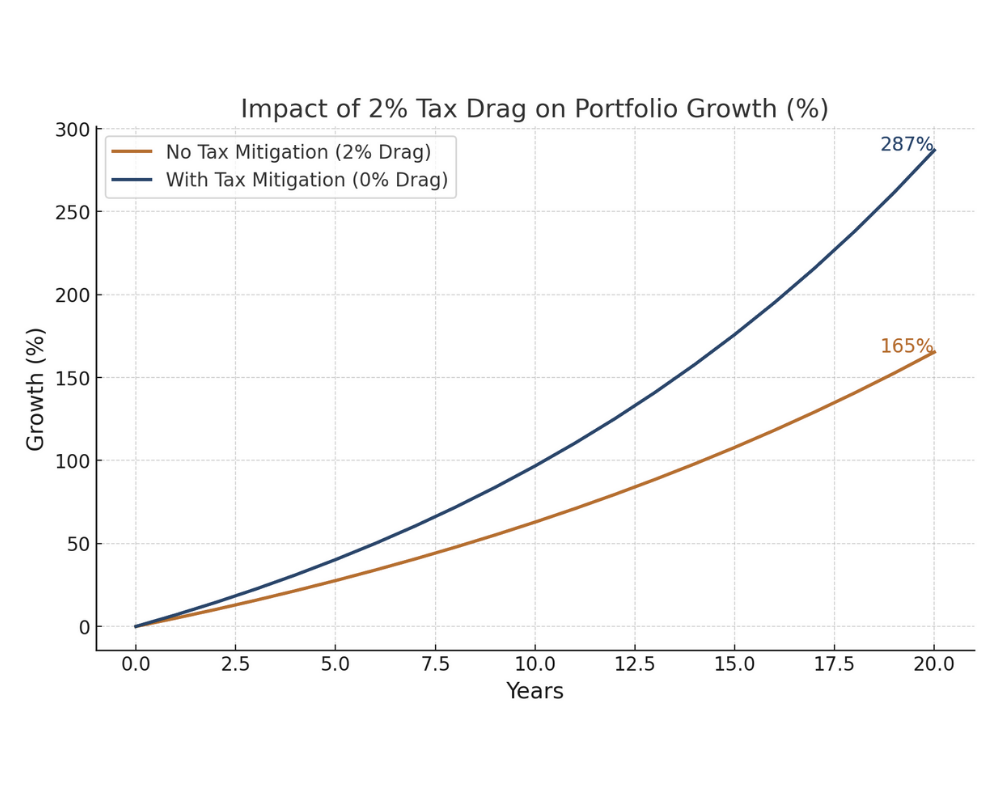

For many ultra-high-net-worth families, handing over millions of dollars in taxes each year to federal and state governments is one of the greatest drags on their wealth. When it comes to strategies for managing and growing wealth, taxes primarily occur along two tracks: ongoing portfolio income and major events, like the sale of a business or the transfer of an estate.

For this reason, proactive, strategic, and customized tax mitigation strategies are essential for wealthy families because they will reduce tax drag, maximize how their wealth compounds over time, and preserve multi-generational wealth.

Caprock navigates both tracks with finesse, employing a diverse arsenal of strategies and techniques to minimize avoidable tax drag.

You’ll often hear us say:

“It’s not what you make; it’s what you keep.”

More than just a slogan, this is a principle that influences our every decision.

A proactive tax mitigation framework for investing

Caprock’s tax mitigation philosophy is based on the belief that after-tax returns, not pre-tax performance, are what matter most for long-term wealth creation.

The consistent compounding of after-tax returns is a must-have component of building multi-generational wealth, which is why Caprock integrates tax-efficient investing into every layer of its process, from asset allocation to manager selection and portfolio structuring.

While most financial advisors model their portfolios on a pre-tax basis, we take a different approach by focusing on after-tax returns.

This is because tax management and tax efficiency can significantly impact portfolio returns. For instance, two families can experience the same investment growth, but the family that does more to mitigate taxes will hold on to more of its wealth.

To create portfolios that grow without unnecessary tax bills, we leverage tax-efficient asset placement, positioning investments that generate tax-inefficient income in tax-deferred accounts, when possible.

While some managers have high portfolio turnover leading to short-term gains, those gains are taxed at a higher rate. At Caprock, we mitigate this by employing strategies that balance growth potential and tax sensitivity.

We also leverage aggressive tax loss harvesting so that if certain portfolio holdings drop in value, they can be strategically sold to offset other taxable gains.

Event-Triggered Tax Strategies

Wealth is rarely built in a straight line. It’s shaped by significant life events, like the sale of a business, mergers and acquisitions, exercising stock options, or the passing of wealth from one generation to the next which are all influenced by economic policies. To understand how the most recent economic policies in the One Big Beautiful Bill, you can refer to our article on Navigating Economic Policy.

Company Pioneers Reaping Financial Windfall

In the past, only founders and C-level executives experienced significant company liquidity events. However, recent transactions have become much larger, benefiting hundreds of employees who suddenly find themselves with generational wealth.

For example, when a young engineer joins a fast-growing tech startup, he has high hopes that his early involvement and receiving stock in the company could be worth millions or even billions down the road. Fast forward five years to when the startup goes public and the value of his shares experiences a significant surge. Overnight, David and his family become ultra-wealthy and potentially face a seven-figure tax bill.

Moments like these can set in motion significant tax consequences, which is why planning for these events is important. Caprock helps families like these pioneers of disruptive companies to prepare. We work with families before the sale of a business to structure transactions and leverage trusts or charitable vehicles that can reduce the tax burden.

Families Navigating Wealth Transfer

Many of our clients include large families who are navigating the complexities of transferring wealth across generations. These families seek to preserve their legacy while minimizing the tax burden on their heirs. We assist with estate planning, navigating the significant uncertainty as highlighted in a Forbes article, helping clients make gifts, and evaluating philanthropic options that can reduce estate taxes. By leveraging trusts, charitable giving vehicles, and other strategic tools, we assist them in structuring their estate plans to achieve their financial goals and ensure a smooth transition of assets. This proactive approach not only helps in reducing estate taxes but also aligns with their philanthropic aspirations, creating a lasting impact on their communities.

By anticipating these events, rather than reacting after the fact, families are better equipped to control the tax impact. The earlier a family works with a wealth management professional to prepare, the better.

Tax-Efficient Techniques

Tax mitigation isn’t about executing a single strategy. It’s about leveraging multiple techniques that are tailored to a family’s unique goals, timelines, and tax profiles. We work closely with a family’s CPA, estate attorney, and other specialists to align and achieve tax mitigation and wealth creation goals.

At Caprock, some of the tools we commonly use are:

- Trust structures that help move assets to heirs in a tax-aware way

- Family entities that can consolidate assets and enable discounted transfers for estate planning

- Charitable giving vehicles, such as donor-advised funds (DAFs), that help manage income and capital gains taxes

- Tax-advantaged and other specialized investments that can improve after-tax cash flow

Technology plays a crucial role in implementing tax-efficient techniques. By providing real-time data and analytics, these tools help us identify assets that can be strategically sold to offset taxable gains, ensuring that our clients’ portfolios are always optimized for tax efficiency.

Another critical element of the tax mitigation toolbox is vigilance. Tax rules are constantly in flux, especially as government administrations change, so working with professionals who have a finger on the pulse of new and evolving tax laws (and can adapt to them) is a must.

Aligning tax mitigation with wealth creation goals

One of the most controllable drivers of long-term, multi-generational wealth is effective tax planning. Caprock helps families keep more of what they’ve worked so hard to build by crafting tax-aware portfolios, planning for major life events, and using the right tools at the right time.

Ready to benefit from tax-efficient wealth management? Contact us for a confidential discussion and see how Caprock can help you preserve and grow your wealth.

Preserve and grow your wealth with Caprock

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training. Caprock, its Employees, Affiliates and Advisers are not tax or legal professionals and do not provide such advice. Therefore, the discussions contained herein are for informational purposes only and should not be construed as a recommendation or endorsement of a strategy. Please consult with your tax or legal professional for further guidance and information.