Mitigated 70M Metric Tons of Emissions, Financed 20,000 Affordable Housing Units, and Generated 19M MWh of Energy

BOISE, SEPT. 17, 2025 — Caprock, a leading multi-family office Registered Investment Advisor (RIA) serving ultra-high-net-worth clients, has released new data showing that its clients’ investments are driving positive impact across important areas such as affordable housing, financial inclusion, resource sustainability, and renewable energy.

Over the past 16 years, the firm has deployed more than $2.5 billion in impact investments, helping families and foundations create social and environmental change alongside strong financial returns. “We take a deeply integrated approach to impact investing, creating tailored strategies that align with our clients’ values and goals,” said Greg Brown, Caprock Co-CEO. “Our clients range from those who are just beginning to explore impact investing to those pursuing 100% impact orientation in their portfolios. Over the years, we have found some of the most compelling investment opportunities are those that are also solving important challenges around the world.”

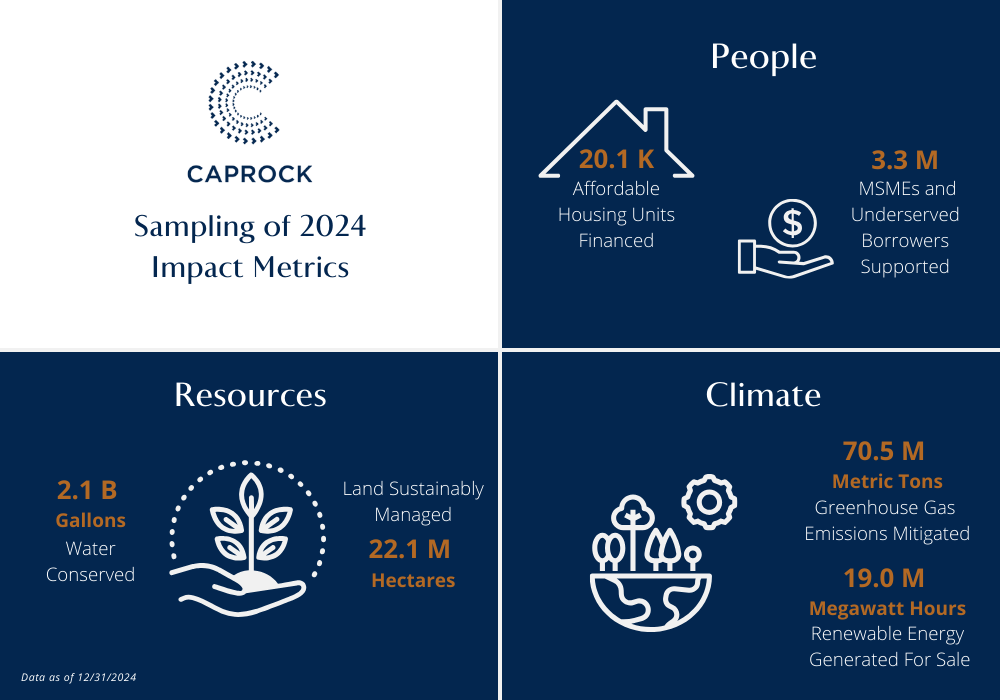

A sampling of the impact generated in 2024:

- Mitigated more than 70 million metric tons of greenhouse gas emissions, the equivalent of taking about 16.4 million cars off the road for a year.

- Generated nearly 19 million megawatt hours of energy, equal to powering 1.8 million homes a year.

- Sustainably managed more than 22 million hectares of land, which is roughly the size of Utah.

- Conserved more than 2 billion gallons of water, which can fill more than 3,100 Olympic-sized swimming pools.

- Financed more than 20,000 affordable housing units.

- Supported over 3 million loans to micro-, small- and medium-sized enterprises and underserved borrowers.

*Impact metrics for 2024 were sourced from the BlueMark Impact Reporting Platform, as reported by Caprock’s participating fund managers.

The firm tracks impact across private market investments through more than 125 active metrics, offering clients a clear and comprehensive view of the results their capital is generating. Notably, Caprock’s 2024 data demonstrates sustained and growing impact across key metrics. Sophie Kelly, Caprock’s Director of Impact Investments, shared, “It’s clear that the strategies we’re recommending are generating measurable impact that continues to scale as more capital is deployed. Looking ahead, we see a compelling and expanding opportunity set to address critical needs while delivering market-rate returns, particularly in areas such as affordable housing to help ease the national shortage and renewable energy where demand is accelerating due to the AI boom.”

Earlier this year, Caprock transitioned its proprietary impact reporting platform to BlueMark, a leading independent impact verification and intelligence provider. Under BlueMark’s stewardship, the platform now equips investors with a suite of tools to collect, validate, and interpret impact data across diverse portfolios. BlueMark enhances its capabilities with intuitive portfolio analytics, streamlined reporting workflows, and access to industry-leading benchmarks, empowering investors to manage and communicate their impact with greater consistency, transparency, and efficiency.

“As impact becomes a key dimension of more investment portfolios, a new suite of data and portfolio management capabilities is required to unlock more effective decision-making and performance monitoring,” said Sarah Gelfand, President at BlueMark. “BlueMark’s market intelligence platform provides investors with a way to build and monitor their portfolios to deliver impact in line with their goals.”

Caprock and BlueMark will continue their support of the impact investing ecosystem at Climate Week NYC from September 21 to 28, where both firms will join peers to further advance the field.

©Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training. Caprock, its Employees, Affiliates and Advisers are not tax or legal professionals and do not provide such advice. Therefore, the discussions contained herein are for informational purposes only and should not be construed as a recommendation or endorsement of a strategy. Please consult with your tax or legal professional for further guidance and information.