By Greg Mech, Managing Director, Client Advisor

In a time of growing charitable need and shrinking nonprofit support, Donor-Advised Funds (DAFs) are uniquely positioned to make a transformative difference. Contributors to these funds have the power to make a significant impact on the causes they care most about, all while enjoying the benefits of strategic philanthropy. This is the promise of DAFs. But many people don’t know exactly what a DAF is, and why now is such a crucial moment for donors to take action.

What Is a DAF?

A Donor-Advised Fund (DAF) is a philanthropic vehicle that allows individuals, families, or organizations to make a charitable contribution—using cash, securities, or other assets—and receive an immediate tax deduction. Once the assets are in the DAF, they can grow tax-free and be granted to IRS-qualified public charities at any time.

DAFs are accessible to a broad range of donors. While they are often associated with high-net-worth individuals, many sponsoring organizations allow DAFs to be opened with initial contributions as low as $5,000 to $25,000.

Individuals can establish a DAF through a public charity, community foundation, or financial institution offering DAF services. Typically, the process entails an initial contribution, account naming, and ongoing grant recommendations.

The Growth—and Untapped Potential—of DAFs

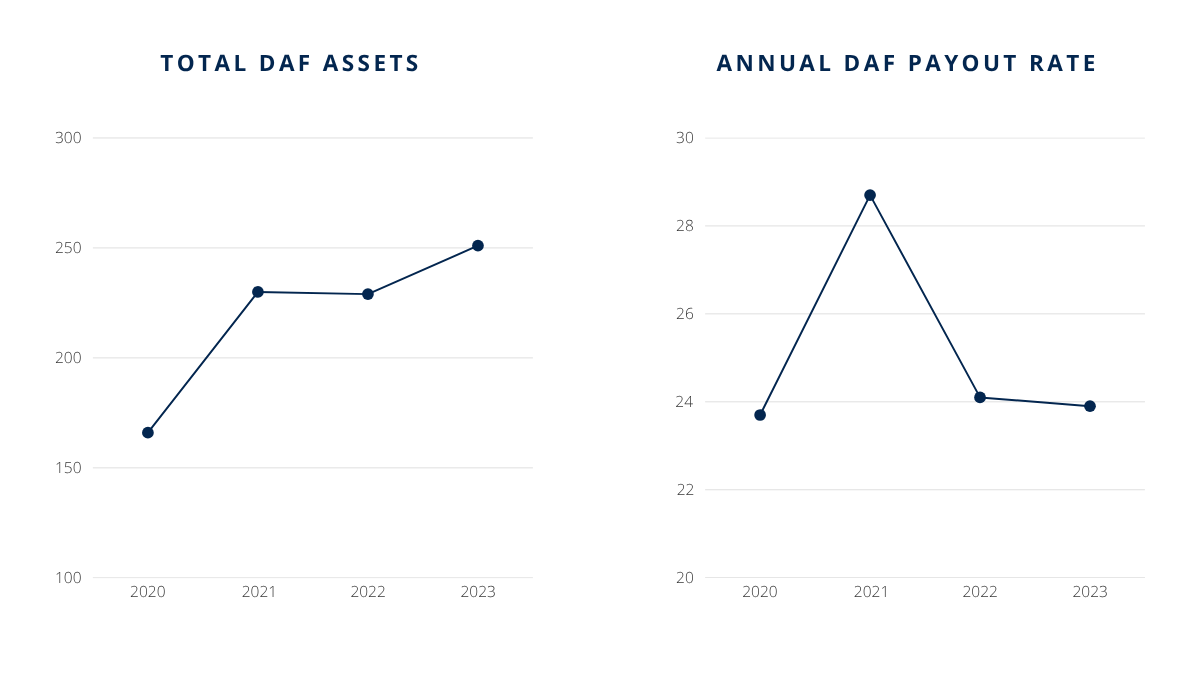

With billions of dollars in charitable assets waiting to be deployed, now is the time for DAF contributors to step up and make a difference. According to the National Philanthropic Trust’s 2024 Donor-Advised Fund Report, DAF charitable assets have grown from $166 billion in 2020 to over $250 billion in 2023, reflecting a 51% increase over three years. Despite this growth, the payout rate of these assets granted to nonprofits remains at nearly 24%. This means that a vast reservoir of charitable capital remains idle while nonprofits face mounting challenges.

There are several reasons why so much capital sits idle, including the absence of a legal requirement for payout timing and the fact that donors receive the full tax benefit of contributing to a DAF upfront, allowing for delayed decision-making by the donor. I’ve seen many cases in which a donor will use a DAF as a method for long-term charitable savings without having a clear distribution plan in place. And once the money goes into the DAF, it often becomes out of sight, out of mind.

Engaging Families in Philanthropy Through DAFs

In addition to supporting charitable organizations, DAFs are powerful tools for educating, engaging, and empowering younger generations around philanthropy. Instead of making it about wealth, families can use DAFs to foster generosity, shared values, and social responsibility. Families can involve children in selecting charities, reviewing grant applications, or even setting annual giving goals to instill values of generosity and civic duty.

Individuals and families can consider multi-year granting strategies, impact investing within their DAF, or partnering with nonprofits to fund specific programs for greater transparency and measurable results. For example, I once worked with the retired CEO of a public company who remained passionate about a specific cause within the industry he served. Instead of making one-off donations to multiple organizations that supported this cause, he used a DAF to launch a multi-year initiative, partnering with major institutions to effect change. His mission had metrics, partnership, and lasting impact.

Why This Matters Now

In 2025, nonprofits are navigating a perfect storm of political uncertainty and dwindling government support. These organizations are vital to our communities, supporting the underserved, enriching lives through the arts, advancing education, and promoting mental health. The funding gap left by reduced public support threatens their ability to serve.

This is where DAFs can step in—not just as a financial tool, but as a force for good.

With less than a quarter of DAF assets distributed annually, there is a significant opportunity for DAF owners to think more strategically and act more generously. Now is the time to:

By offering a flexible platform for charitable giving, DAFs allow individuals and families to be more intentional and strategic in their philanthropy. Donors have opportunities to support causes consistently over time, respond quickly to urgent needs, and involve the next generation in making meaningful decisions.

Legacy, Values, and the Future of Wealth

There are only four places wealth can go: lifestyle spending, future generations, philanthropy, or taxes. Understanding how to balance these areas can help families optimize their resources for maximum impact. DAFs offer a powerful way to align wealth with purpose, ensuring that your legacy is not just financial but deeply meaningful.

Amplify Your DAF’s Impact Today

Acting today can ensure your legacy extends beyond financial wealth to create lasting, meaningful impact. If you don’t yet have a DAF, now is the perfect time to consult with your financial advisor to establish one. For those with an existing DAF, your advisor can assist in identifying the best ways to direct your funds toward the causes that matter most to you.

About the Author

Greg Mech is a Managing Director of Caprock, where he advises families on wealth management and philanthropy, drawing on over four decades of experience in global financial markets. Greg is also deeply involved in community initiatives and charitable organizations, reflecting his commitment to using wealth as a tool for meaningful impact.

©2024 Caprock. All rights reserved. The Caprock Group, LLC (“Caprock”) is an SEC Registered Investment Advisor. This communication is not an offer or solicitation with respect to the purchase or sale of any security and is for informational purposes only. Information contained herein has been derived from sources believed to be reliable, but Caprock makes no representations as to its accuracy or completeness. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns. Registration with the SEC does not imply a certain level of skill or training.